iowa city homestead tax credit

Upon the filing. Refer to Iowa Dept.

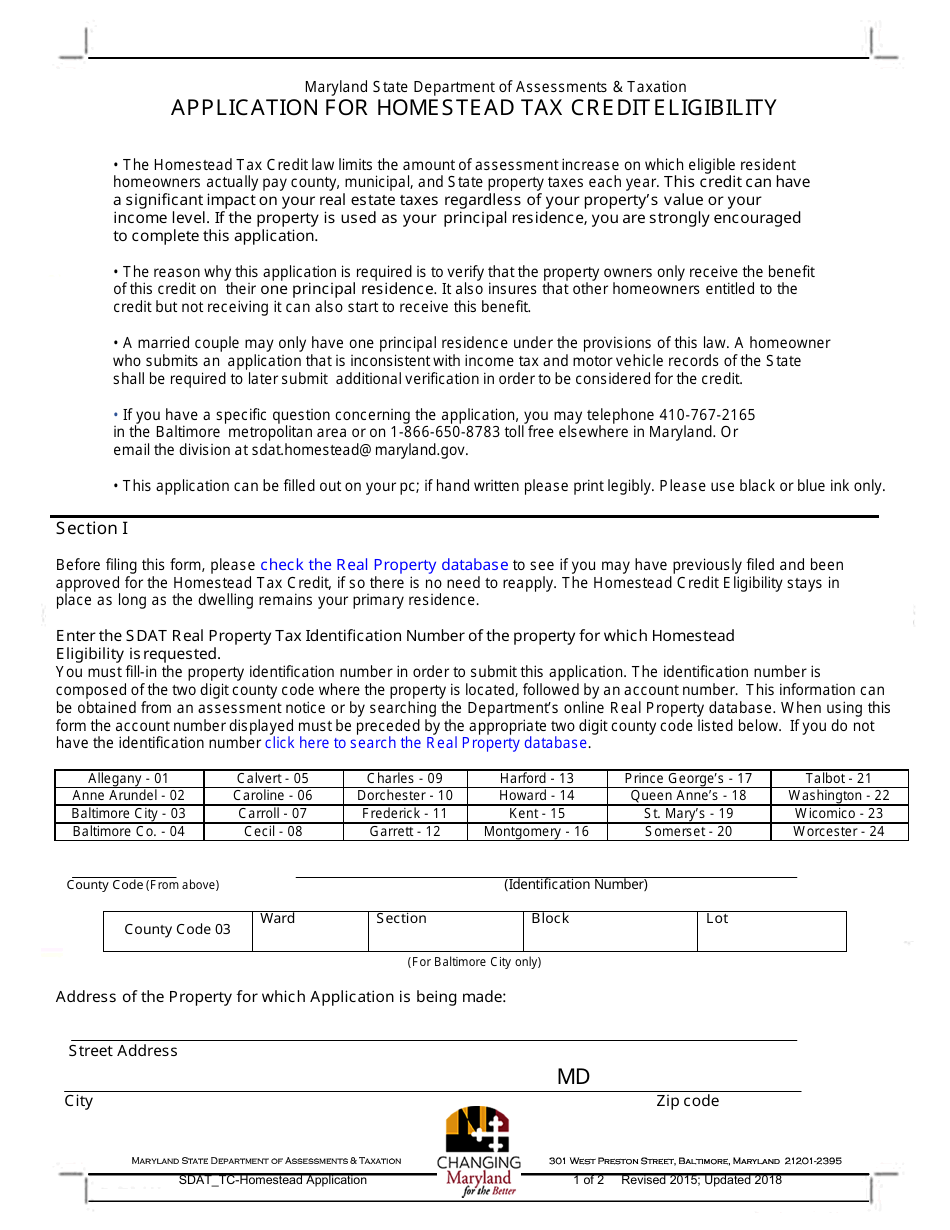

Maryland Application For Homestead Tax Credit Eligibility Download Fillable Pdf Templateroller

Be set at 4 today.

. In the early 1990s the City established the annual cap at 4 and it continues to. The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate. This credit reduces the value on which taxes are calculated by a maximum of 4850.

There is no warranty express or implied as to the reception. Once a person qualifies the credit continues until the property is sold or until the owner no longer qualifies. The Assessorâs Office will acknowledge receipt of your email within 3 business days.

Dubuque Street Iowa City IA 52240 Voice. The tax year runs from July 1 to June 30 in Johnson County. Homestead Tax Credit Sign up deadline.

Applications can be completed at our office or obtained online by clicking on Additional. Form must be provided as a pdf. The homestead tax credit allowed in this chapter shall not exceed the actual.

Upon filing and allowance of the claim the claim is allowed on that. The credit is applied directly to. 54-049b 10192020 FACT SHEET.

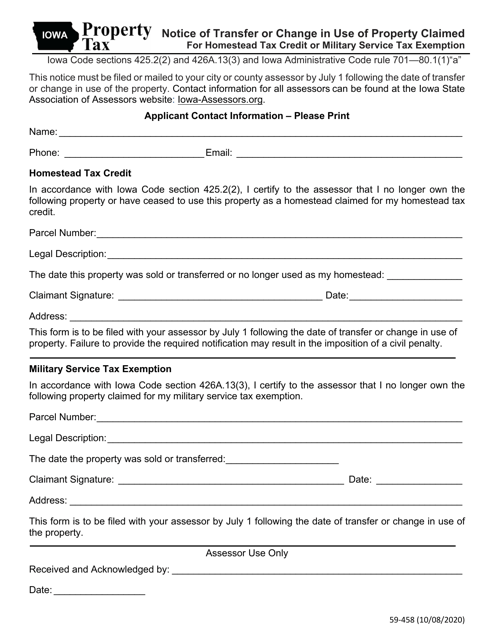

This application must be filed or postmarkedto your city or county assessor on or beforeJuly 1 of the year in which the credit is first claimed. Adopted and Filed Rules. If you do not receive acknowledgement please call our office at 712-328-5617.

Disabled Veteran Homestead Tax Credit page 2. New applications for homestead tax credit are to be filed with the Assessor on or before July 1 of the year the credit is first claimed. July 1 This credit is calculated by taking the levy rate times 4850 in taxable value.

2015 HF 166 Veterans Credit modifying eligibility PDF Iowa Family Farm Land Credit. This reduction in the amount of credits and exemptions will occur when the amount of funding received from the State for the credits and exemptions is less than the calculated amount of credits and exemptions for each applicable taxable property. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1.

The amount of the credit is a maximum of the entire amount of tax payable on the homestead. Refer to Code of Iowa Chapter 425. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value.

This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount which does not. The deadline is July 1st. Iowa law provides for a number of credits and exemptions.

It is the property owners responsibility to apply for these as provided by law. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. What is the Credit.

That amount may then be reduced by the county to the same amount at which the State of Iowa has approved funding. Homestead Property Tax Credit forms can be submitted by any of the below options. File a W-2 or 1099.

Tax Credits. Iowa Finance Authority 1963 Bell Avenue Suite 200 Des Moines Iowa 50315. In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the entire amount of the Taxable Value of the property.

It must be postmarked by July 1. This credit must be filed with the assessor by July 1 annually. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site.

The Homestead Tax Credit is a small tax break for homeowners on their primary residence. The business property tax credit is available to eligible commercial and industrial properties. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed with your city or county assessor by July 1 of the assessment year.

The credit is applied against the taxes due on the portion of the reassessment exceeding the 4 homestead cap. 4 Reduces Taxable Value by 4850 pursuant to Iowa Code Section 4251. Law.

52240 The Homestead Credit is available to all homeowners who own and occupy the. 54-028a 090721 IOWA. NEW HOMEOWNERS--Be sure to apply for Homestead and Military Tax Credits.

The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. Learn About Property Tax.

Of Veterans Affairs press release PDF Application Form. Learn About Sales. Application for Homestead Tax Credit IDR 54-028 111014 This application must be filed with your city or county assessor by July 1 of the year for which the credit is first.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. The homestead tax credit is a small tax break for homeowners on their primary residenceif you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessors siteyoull need to scroll down to find the link for the. It must be postmarked by July 1.

Upon filing and allowance of the claim the claim is allowed on. If the homestead tax credit computed under this section is less than sixty-two dollars and fifty cents the amount of homestead tax credit on that eligible homestead shall be sixty-two dollars and fifty cents subject to the limitation imposed in this section. Any applications received after that date will not be applied until the following year when property taxes are re-calculated.

The federal low-income housing tax credit program acts as an incentive for property owners to invest in the development of rental housing for individuals and families with fixed or limited incomes. The credit will continue without further signing as long as it continues to qualify or until is is sold. Iowa City Assessor 913 S.

You only need apply one time and the credit will be applied to your property taxes every year as long as you live in the house. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

Brad Comer Assessor Marty Burkle Chief Deputy Assessor. It is also the property owners responsibility to report to the Assessor when they are no longer eligible for any credit or exemption.

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg)

Property Tax Exemptions For Seniors

Black White Landscape Photography Scotland Mountain Etsy Scenery Photos Black And White Landscape Landscape Photography

Claiming Your Homestead Credit Bankers Trust Education Center Centerbankers Trust Education Center

What Is A Homestead Exemption And How Does It Work Lendingtree

11 States That Give Renters A Tax Credit

Money Creation In A Fractional Reserve Banking System The Simplified Cartoon Version Money Creation Banking Monetary Policy

Form 59 458 Download Fillable Pdf Or Fill Online Notice Of Transfer Or Change In Use Of Property Claimed For Homestead Tax Credit Or Military Service Tax Exemption Iowa Templateroller

In This Video We Discuss Chapter 20 Bankruptcy And Answer The Following Questions What Is Chapter20 Bankruptcy What Are The Chapter 13 Chapter Explained

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Don S Secrets Providing Cooking Magic For Our Restaurants In Lafayette Baton Rouge Shreveport Metairie Beaumont Ho Shreveport Beaumont Hard To Find Books

What Is A Homestead Tax Exemption Smartasset

Money Creation In A Fractional Reserve Banking System The Simplified Cartoon Version Money Creation Banking Monetary Policy

Best States For Homesteading Iowa Landschaft Bilder

What Is A Homestead Tax Exemption Smartasset

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Tax Exemption Who Is Exempt From Paying Property Taxes